By: Shannon Gayton & Lauren White

The COVID-19 pandemic has caused major disruption throughout the flooring market in 2020, with half of survey respondents reporting a decrease in demand and building starts during the shutdown.

For most respondents, the outlook for 2021 remains largely uncertain and dependent on the status of the virus, availability of a vaccine, and outcome of the upcoming election.

Of those surveyed, 41 percent expect sales in 2021 to grow by 3 to 7 percent, while only 3 percent expect sales to drop more than 8 percent. Other factors affecting businesses include:

• Fewer in-person meetings

• Less on-site interaction and more video conferencing

• Increased social media spend

• Increased need to invest in digital tools, including e-commerce

• Limited contact with homeowners

• Development of safe health practices

• Reduced inventory and number of SKUs

• Availability of online training

The consensus leans toward a slower recovery, but some remain optimistic about the upcoming year. One contractor said: “We shut down for six weeks and once we started back, we were really busy. People had a lot of time confined to their homes and could take a good look at what needed to be done. They want work done now.”

Another member expects demand to increase in 2021, citing “an increased volume of work from the desire to update homes due to shelter-in-place. More so because of people needing to adapt their home for home offices.”

“The hangover from the economic downturn will be significant. However, we do expect an increase in business from urban development and renewal to suburban and rural migration,” an NWFA member said.

Santo Torcivia, President of Market Insights LLC, a market research consultancy for the North American flooring industry, wrote in Hardwood Floors magazine (August/September 2020) that housing construction is positioned to see lower volumes through the remainder of this year, but is slated to experience moderate growth from 2021 to 2025. Despite an expected drop in existing-home sales for the remainder of 2020, consumers are expected to take advantage of lower prices during and after the recession. Residential remodeling is expected to rebound as consumers refit homes before selling or shortly after purchasing a new one.

With mortgage rates trending down throughout 2020, average rates on fixed mortgages are anticipated to continue their decline along with refinance rates. While interest rates remain in a state of flux, many economists expect rates to dip below 3 percent, incentivizing home buyers and remodelers to invest in new builds, remodeling, or refinancing activity.

In July 2020, the National Association of Home Builders (NAHB) presented similar data that low interest rates are spurring potential buyers to action. Construction and remodeling markets remained strong throughout 2020, despite shutdowns.

When survey respondents were asked to rank their concerns for 2021, the economy tied with the impact of COVID-19, each garnering almost 59 percent of responses; 56 percent indicated that the political climate remained a top concern going into 2021 with the presidential election in November.

ADAPTING TO COVID-19

Several NWFA members reported record sales in the months before the COVID-19 pandemic. However, when asked how the pandemic affected their business, 50 percent reported a decrease in business, 41 percent reported supply chain disruptions, and 38 percent reported increased lead times.

Downward pressure on margins also was felt by 29 percent of survey respondents. This relative uncertainty has led to significant changes in the way many do business.

Some contractors reported operational changes such as providing virtual estimates and video chats with customers to approximate measurements and style choices before entering a customer’s home. Once arriving on site, masks, gloves, booties, and other coverings have been used to other homeowners additional comfort.

To mitigate the impacts of COVID-19, some NWFA members reported:

• Applying for PPP funds

• Implementing stricter cleaning schedules and social distancing

• Availability of remote work options and flexible PTO

• Reduced field staff

• Increased social media and technology investment

• Increased sample shipments to customers

• Appointment only showroom visits

• Mask requirements onsite and in showrooms

NWFA contractor Jorge Perez of Epic Hardwood Floors LLC said that during the shutdown, many homeowners were tackling easier projects such as painting, but flooring projects were likely outside of their comfort zone. Customers remained fearful of the virus and leery of in-home visitors, so Perez adjusted. “We’ve been successful at making our clients feel safe and comfortable with our service,” he said. “I’m working with a customer right now and we have had no contact, whatsoever. We do videos for them to let them know where we are each day. That has been helpful to offer them peace of mind.”

Some distributors experienced less impact from the coronavirus as they already had implemented changes such as improved online offerings before the arrival of the virus. “Revel Woods was perfectly positioned to facilitate buying,” said Craig Dupra, President at Revel Woods Flooring and Chairman of the NWFA’s Board of Directors. “Everything we do is online and we ship samples. If anything, COVID actually enhanced the value of that business. Customers would ask where they could go to see products. We said they don’t have to go anywhere; we’ll send our products directly to them.”

Another distributor noted their inventory strategy became a main driver in mitigating the impact of COVID-19. “Our company has invested in analytics in a big way,” said David Williams, Vice President of Horizon Forest Products. “You can really figure out what you need to reduce or what you need to hold onto. When you’re going through a downturn, you really want to reduce that high-cost inventory.”

Supply-chain concerns have remained top-of-mind in the flooring industry for many reasons, but COVID-19 proved to be a turning point for many manufacturers. Canada-based Preverco’s Vice President of Sales and Marketing Julien Dufresne reports little impact from the supply chain as the company has been sourcing wood from local and regional lumber yards for years.

“We didn’t expect it to be a virus that would create the lack of supply, but maybe tensions with Russia or China,” he said. “It turned out the virus did stop some of the supply chain, but we had already made those changes a few years ago to not depend on outside resources.”

Retailers may have been the hardest-hit segment in this year’s survey, experiencing a decrease in demand and an increase in supply chain disruptions and lead times. They’ve also had to transform operations to mitigate risk with daily temperature checks and symptom evaluation of office, warehouse, and field installation personnel, as well as providing hand sanitizer and masks to customers and sanitizing samples and showrooms daily.

OFF THE ROAD AND DOWN TO BRASS TACKS

The COVID-19 pandemic has forced many leaders to spend more time in the office, giving them the opportunity to become more efficient.

“When you’re in an office, even though I like to be out, it does give you more time to spend on the details,” said Jodie Doyle, Vice President of Sales and Marketing for Indusparquet USA. Doyle and his team compiled a list of tasks they’d been putting off or wanted to do and divided them among themselves.

As a result, Doyle says they’ve become a better-run company. They also invested in new CRM software and a website redesign. “We took time to invest in technology, as well,” Doyle said. “I think technology is going to be huge moving out of this.”

Sam Hirsch, CEO of Richard Marshall Fine Flooring Inc., also managed to make improvements during the downtime. “I’m an analytical person by nature,” Hirsch said. “I spent a lot of time looking at what we’re making money on, what we’re not making money on, how much money we should be making, where we’re missing the mark, trying to get more data, and get more analytical about my business.”

LONGER, WIDER PLANKS IN NATURAL FINISHES

In 2021, most respondents forecast hardwood flooring trends will continue in the same direction they expected in last year’s survey. They expect to continue to see increased demand for longer, wider planks and natural finishes. Nearly 45 percent of respondents said natural wood colors will increase in demand, and around 57 percent expect increased demand for wide planks.

Dufresne said he’s not only seeing a lot of 7-inch boards, but also 8- and 9-inch boards. He expects natural tones and light colors will continue trending.

This is in keeping with last year’s outlook. However, where respondents last year said darker colors were going out, 44 percent of this year’s respondents expect demand for darker colors to remain the same, and 21 percent anticipate increased demand for them.

Perez is still installing a lot of darker-color wood, and he said it’s because people want contrast. “It’s what everyone’s seeing on social media, on TV, and in magazines,” Perez said. “Everybody has a white couch or there’s some white aspect on the wall, countertops, and baseboards. A darker floor always makes that pop.”

“Homeowners love contrast,” another respondent noted. Many others remarked about the influence of social media and television, with one citing Pinterest as the number one influence for their clients. Many forecast home renovations will grow, especially if remote work continues to be the norm, and homeowner sentiments could greatly influence trends.

Williams has noticed trends turn more quickly these days, and postulates this may be another byproduct of home renovation shows. “Colors can pop in and pop out fairly quickly,” Williams said. “You could see a run on a particular gray and, unlike in the past where that would run for a long period, you could have a two-month, three-month run and then it could change all of a sudden.”

Gray stains and finishes continue their slow exit. Last year’s respondents reported they were on their way out, and nearly 38 percent of this year’s respondents said demand for them will stay the same. One respondent remarked: “Gray has peaked.”

Around 45 percent of respondents forecast natural wood colors will see increased demand in 2021. Many also expect unfinished and textured wood to trend. “Textures have become very popular, over double from the last two years,” one respondent said. However, that doesn’t extend to hand-scraped wood, which continues to reflect low demand. Instead, factory-finished and engineered flooring are expected to see increased demand.

White oak is expected to continue trending in 2021. Around 62 percent of respondents expect higher demand. “White oak has blown up,” one respondent said. Many anticipate lower demand for exotics, however, with some remarking that people will favor domestic products next year.

WOOD-LOOK THREAT: MARKETING, MYTHS, AND MINDSETS

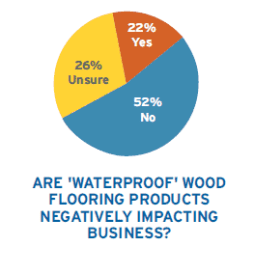

Concerns of competition with wood-look products continue this year, with about 57 percent of respondents reporting a negative impact on real wood sales in 2020.

LVT is considered the biggest longterm threat to real wood products, ranking highest among respondents at 38 percent. WPC and laminate also are notable competition. Some mentioned that big projects like highrise developments, hotels, condos, and commercial buildings are going for these alternatives. They cite the lower price and lower maintenance nature of wood-look products as primary reasons for their demand. However, many hold that the marketed durability, longevity, and water resistance of these products are myths.

Several respondents cited marketing as a major challenge in competing with wood-look products. One said wood needs to take a page out of LVT marketing’s playbook, and that the industry needs to stress the resilience and superior financial investment of wood. One respondent said: “Wood is the only product that has a real organic connection with and real psychological impact on humans. Why isn’t this stressed in marketing?”

Perez has similar sentiments, saying the industry should market attributes of wood that wood-look products can’t replicate, such as the ability to add texture and change its color or appearance. He said the renewability, longevity, adaptability, and resale value of wood are key selling points, and educating customers on these will help them see they’re not saving money in the long-run with wood-look products.

Doyle said it’s difficult to get the right narrative to the end-customer when many in the industry are advertising to the trade. It’s challenging to create a narrative people can replicate and communicate to customers. “The industry as a whole needs to do a better job communicating why wood is a better product than plastic,” Doyle said. This might mean exploring more direct marketing to end customers, such as through social media.

Despite the threat of wood-look products, several respondents anticipate customers will return to real wood in the coming years. “I think people are having issues with those products now that they’ve been out for a few years,” said Dufresne. “I think 2020 could have been the peak for that and a lot of people might go back to wood.”

Williams expects sales of real wood flooring to be up significantly in 2021, in line with about a fifth of survey respondents. He said that, while vinyl products have strained the hardwood industry during the past few years, people will soon realize they prefer real wood and shift back.

Drew Hash of Shaw Industries Inc., said his company has embraced “waterproof” wood-flooring products. “We kept challenging ourselves to raise the bar within the wood category, to give our products more attributes consumers relate to,” he said, adding that consumers now relate more to the low maintenance attributes of wood-look products, despite the fact that they still aspire to real hardwood floors.

His team looked at ways to treat or coat wood to make it more water-resistant. They also looked at hybrid wood products that solve consumer demand for style and simplicity. Shaw introduced three new products that are doing well. “We applied our new REPEL water-resistant technology to our engineered hardwood products, which also are made in America,” Hash said. “Taking things a step further, we introduced two new collections. We’re committed to innovation in the wood category and will continue bringing solutions to our customers.”

CONTRACTORS

NWFA contractors have moderate to high expectations for wood-flooring sales going into 2021. Around 35 percent expect sales to be about the same, 24 percent expect them to be up somewhat, and nearly 22 percent expect them to be up significantly.

Among contractors who anticipate a lift in sales, many cite a shift back to normal after the initial effects of COVID-19, a good market, and customer appreciation of hardwood and the benefits of solid surfaces. Many contractors with moderate to low expectations cite COVID-19 as the reason for their forecast, anticipating continued impacts into the new year.

Finding adequate skilled labor continues to be a challenge for contractors, with nearly 63 percent saying it has been an issue this year. Several noted that modified unemployment benefits have kept people from rejoining the workforce.

Sam Hirsch, CEO of Richard Marshall Fine Flooring Inc., said finding skilled labor has been an ongoing issue since long before COVID-19. Even when the economy was doing great, it was hard to find skilled workers at the going pay rate, he said.

Jorge Perez of Epic Hardwood Floors LLC said a higher cost of living and the younger generation’s lack of interest in manual labor are key reasons he has struggled to find skilled labor. He said potential employees expect high pay when they don’t yet have adequate skills or knowledge.

Other reasons contractors cited include:

• Those with prior skillsets don’t want to follow new standards

• Labor pool in the area is limited

• Reduced business has limited contractor ability to hire full-time

However, some contractors have seen an influx of applications from workers who’ve lost their jobs due to COVID-19. Nearly 38 percent say they haven’t had issues finding skilled labor this year, and some haven’t needed to hire at all.

Most contractors (92 percent) installed flooring purchased from wood flooring distributors in 2019. Nearly 45 percent installed wood purchased directly from manufacturers, and nearly 24 percent installed wood purchased from independent/specialized floor-covering retailers. The percentage who installed wood purchased from the client fell from 46 percent in 2018 to 29 percent in 2019.

“It is very helpful to my business that my local distributors do such a good job of procuring and inventorying the products we use,” one contractor noted. Others said they like buying from distributors they know and trust, saying their preferred channels provide customer service, knowledgeable staff, and quality products.

Plainsawn continues to be the most common cut of flooring (nearly 78 percent), and nail down over wood subfloors is the most-common installation method (nearly 73 percent). Water-based finishes are the most-frequently-used thus far in 2020 (around 62 percent), followed by oil-modified finishes (27 percent).

As far as trends, contractors expect wider planks, natural looks, and longer boards to continue trending in 2021, as well as engineered flooring. They expect gray stains and finishes to see similar demand next year, and some even expect growth in this category. Many predict natural, lighter colors to see higher demand, with 60 percent expecting notably higher demand for white oak, a perennial favorite in recent years.

On darker stains and colors, contractors are split. One respondent said their clientele is shifting away from darker floors; another said they’re doing a lot of dark stains in warm tones. The data reflects this split, as most contractors expect demand for darker colors to stay the same (45 percent), nearly a quarter expect it to decrease (nearly 23 percent), and more than a quarter expect it to increase (almost 28 percent).

As with the past several years, contractors continue to face pricing competition due to unrealistic expectations concerning cost and timing for wood flooring installations. This year, however, they also have been challenged by COVID-19. Nearly 43 percent experienced decreased demand, and the same percentage had increased lead times. Only 28 percent saw an increase in demand. And 45 percent of contractors reported supply chain disruptions. Other effects include decreased employee productivity (28 percent) and downward pressure on margins (25 percent).

“There’s a lot of discounting pressure,” Hirsch said. He has had to be willing to walk away rather than take a job at too large of a discount. “There are a lot of reasons you need your prices tom hold, or even be higher,” he said. “Fighting that desire to book jobs and not letting fear drive the decision-making, but trying to make good business decisions every day.”

As far as decreased demand, Perez said it comes down to customers’ fears, especially with older generations and families with children. However, he said the fear is starting to subside and the phones now are ringing nonstop. With people spending so much time at home, Perez believes they’re realizing they want to make updates.

Many are unsure how COVID-19 will affect their businesses next year, saying it will depend on the virus, a vaccine, and politics. While some are hopeful about an increase in demand, others anticipate a decrease. In 2021, many aim to focus on their website, social media, advertising, and marketing efforts. Others plan to:

• Improve on staffing and provide better employee training

• Reduce or raise prices

• Educate their client base

• Improve customer service

“Given the way this year has played out, with everything from COVID-19, I’ve sort of given up trying to predict the future and I just try to make the best day-to-day decisions,” said Hirsch. “Hopefully that will lead to a good result regardless of what the future looks like.”

Distributors

Distributors remain optimistic despite COVID-19. About 44 percent of distributors surveyed reported wood flooring sales in 2019 to be about the same compared to those in 2018. About a third reported a significant increase in sales above 8 percent.

Halfway through 2020, more than half of distributors forecast full-year revenues to remain similar to sales in 2019. Another fifth forecast sales would be down 8 percent or more, with many citing the COVID-19 pandemic. To mitigate the impact, some distributor members have taken steps including:

• Counter shields, masks, and hand sanitizer on counters

• Increased cleaning of surfaces

• Decreased inventory levels

• Shorter working hours, lower travel expenses, work-from-home options

• Increased social media and digital investment

• Applying for Paycheck Protection Program (PPP)

• Limited showroom access

Competition from wood-look products such as WPC, LVT, and laminate continues to adversely affect NWFA distributors. One distributor said: “Wood-look product demand has continued to grow. However, we focus on the natural characteristics in our wood products and continued color development, which cannot be replicated easily in other product categories.”

Water-based nishes account for 88 percent of distributors’ product mix, followed by oil-modified and natural or hard wax oil, and UV/LED cured finishes. Most distributors expect demand for engineered flooring to increase in 2021; most also forecast demand for unfinished flooring to decrease over time.

When asked what distributors deem most helpful to promote real-wood floors, one wrote: “Training material regarding grading, character, and color variation.” Another said: “Addressing end-user perception that wood look floors are indestructible and don’t need maintenance.”

The number one concern plaguing distributors going into 2021 continues to be competition from non-wood floor coverings (67 percent), followed by the economy, competition from big-box stores, and manufacturers selling direct.

Many NWFA distributors are unsure about how COVID-19 will affect their business in the coming year. Some distributors remain optimistic, with 44 percent forecasting sales to increase at least 3 percent in 2021, with another 22 percent anticipating significant growth. “There was already pent-up demand in the housing market,” said David Williams, vice president of Horizon Forest Products. “We slowed down in April and May, but it has taken off like a rocket ship now. I think business is going to pick up pace right through the end of the year.”

The top two opportunities for 2021 among distributors were product diversification and ecommerce. Other opportunities noted included:

• End-market diversification

• Geographic expansion

• Value-added services

• Operational improvements

Other plans for becoming competitive include staying lean, hiring more sales staff, and selling direct to customers who previously have purchased through flooring retailers.

Concerning commodity-level pricing in their markets, some distributors offered strategies such as offering more products and services, and keeping overhead as low as possible. Additionally, distributors currently offering private-label products plan to increase or keep volume the same. When asked what was driving commodity-level pricing in their market, one distributor said: “Flooring stores and many S&F professionals are not good at sales and defer to selling price over value.”

Finding skilled labor hasn’t proven to be problematic in 2020 despite COVID-19, according to most distributors surveyed with a caveat. “Lower quality candidates are looking to come on board. Higher-quality candidates want the security of their current employer,” one distributor said.

MANUFACTURERS

About 30 percent of manufacturers reported sales stayed about the same from 2018 to 2019. About 27 percent reported sales were down somewhat and 12 percent said sales were down significantly (more than 8 percent) for 2019. Around 15 percent of manufacturers said sales were up somewhat (3 – 7 percent). Regarding pricing, most manufacturers (nearly 71 percent) reported prices remained the same in 2020, and nearly 59 percent expect the same to be true in 2021.

Most manufacturers said their primary sales channel was traditional wood flooring distributors. Other sales channels include general floor-covering distributors (50 percent), direct to flooring-specific retailers (35 percent) and direct to builders and installers (32 percent).

When asked about their forecasts for the full year 2020, around 26 percent of manufacturers surveyed reported they expect sales to be down significantly (more than 8 percent) and nearly 21 percent forecast sales will be down somewhat (3 percent – 7 percent). Many cited the impact of COVID-19 as their reason for low expectations.

Going into 2021, manufacturers are optimistic that sales will increase. Around 41 percent expect sales to be up somewhat and nearly 18 percent expect sales to be up significantly (more than 8 percent). “We expect a buying burst when a vaccine is approved,” said one manufacturer surveyed.

“There’s going to be an impact on the first quarter of 2021,” says Julien Dufresne, Vice President of Sales and Marketing for Preverco. “But I’m pretty confident after the first quarter of next year we’re going to see demand come back at the normal level, or maybe a little bit stronger.”

Top opportunities for manufacturers in the second half of 2020 into 2021 include:

• Residential remodels

• New/greater distribution

• Improved training

• New products

• High-end products and projects

One respondent commented, “With home renovations at an all-time high, I believe upgrading residential flooring will be on the rise for 2021.”

Manufacturers also forecasted wood flooring trends going into 2021. They anticipate demand will remain the same for white stains, dark colors, cerused, and gray stains and finishes. They expect an increase in demand for wide plank, long boards, natural wood colors, factory-finished, and engineered. They expect a decrease in demand for hand-scraped flooring. And manufacturers are split as to whether demand will decrease, stay the same, or increase for solids, textured, and unfinished flooring.

As far as species, manufacturers anticipate white oak will continue to gain demand. On the other hand, they said bamboo and exotic woods will continue to see low demand, with several noting the cost of exotics is a deterrent for consumers.

However, Jodie Doyle, Vice President of Sales and Marketing for Indusparquet USA, a manufacturer of Brazilian exotics, anticipates increased demand for exotics into the next year. He’s already starting to see momentum in the second half of 2020 and expects double-digit growth in 2021.

When asked about the impact of COVID-19 on their businesses, manufacturers reported a decrease in demand, downward pressure on margins, and increased lead times/supply chain disruptions.

For Steven Suntup of Elastilon Installation Systems, there hasn’t been much of an impact from COVID-19 except in the area of digital tools. He has had to adopt new technology to network and host virtual meetings.

Manufacturers are split as to how COVID-19 will affect their businesses in 2021. Many are unsure, while others expect a rebound and tremendous growth. Still, others forecast an overall decline in volume and tight margins.

RETAILERS

For many retailers, the COVID-19 pandemic has affected their business negatively. Of those surveyed, most reported increased lead times, a decrease in demand, and other supply chain disruptions. On the other hand, some have seen an increase in demand and even increased profitability.

Other responses included:

• Downward pressures on margins

• Decreased employee productivity

• Decreased lead times

• Increased need to invest in digital tools

When asked what steps they’ve taken to mitigate the impacts of COVID-19, one retailer said: “Start looking at which employees to let go the minute things look like they may be slowing down for the foreseeable future.” Other NWFA retailers reported:

• Applying for government assistance

• Daily temperature checks of all employees

• Daily checklist of symptoms for office, warehouse, and field installation personnel

• Sanitizing samples, showroom, and workstations after each appointment

• Requiring masks with customer visits

• Offering masks and sanitizer to customers

• Social distancing

One retailer’s business model operates primarily through in-home visits; sales representatives arrive onsite with a selection of flooring samples for the customer to choose from. “The clients that were booking appointments were doing more buying than shopping.”

In 2019, 43 percent of NWFA retailers surveyed reported sales of wood flooring were the same as those reported in 2018, while about two-thirds reported sales were up.

Looking ahead for 2020, about a third of respondents expect sales to be about the same, and two-thirds forecast an increase. “We believe people want to invest in their homes and for the higher-end market, they continue to invest even in volatile times,” one retailer explained.

More than half of NWFA retailers surveyed estimated that the percentage of sales attributed to services including installation, refinishing, design, repair, and training will stay the same in 2021; about a third expect those to increase.

Wood-look products such as LVT, WPC, and laminate continue to be problematic for retailers. One retailer said in the survey: “Customers are choosing them because they’re cheaper.” Another attributed growth in demand for those alternatives to wood to “ease of installation, wide variety, water-resistant, less sub-floor preparation, better production rates, and fewer claims.”

When asked which product types experienced a shift in 2020, retailers reported increased demand for factory-finished engineered and factory-finished solid. Demand for antique/reclaimed, unfinished solid flooring, and unfinished engineered remained unchanged for most.

Most retailers that responded to our survey do not expect the end-market mix to shift in late 2020 and into 2021. One retailer said: “It depends on who wins the election. This will be the most important election in our history for the economy.”

Going into the second half of 2020 and 2021, retailers see their top

opportunities in eCommerce, value-added services, and operational improvements. Other responses include product diversification, acquiring new talent and geographic expansion. “The greatest opportunity we have right now is to embrace ever-changing technology that allows us to continually meet the demands of the consumer,” said Mike Turner, Director of Compliance and Installation at 50 Floor.

CAUTIOUS OPTIMISM

When asked how COVID-19 has affected their ability to predict sales in 2021, one respondent put it well: “Extremely difficult to forecast due to the unknowns of a COVID-19 resurgence.”

While uncertainly still looms large over the hardwood flooring industry, and the months ahead may be challenging, there is some cause for cautious optimism. Businesses and homeowners are seeing things from a new perspective, providing unforeseen and unexpected benefits.

“I’ve spent my entire life trying to look around the curve, and frankly, the other side of the curve is unclear,” said Craig Dupra, President at Revel Woods and Chairman of NWFA’s Board of Directors. “Smart businesspeople are managing their cash flow and overhead, and they’re cautious about capital expenditures and not overextending anywhere. That said, I am ready to take advantage if things continue to be good.”